Table of Contents

Online payments are the lifeblood of any e-commerce business. For WooCommerce store owners, choosing the right payment gateway can mean the difference between a seamless customer experience and lost sales. While Stripe and PayPal are popular choices, many other payment gateways might better suit your business needs. This article delves into the alternatives, exploring their features, benefits, and why you might consider them over the traditional options.

Understanding WooCommerce Payment Gateways

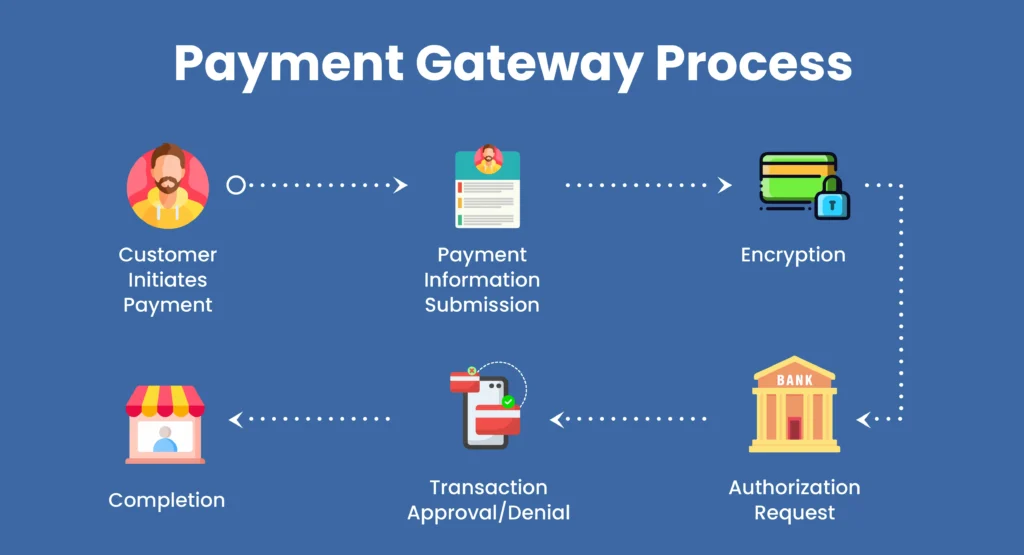

How Payment Gateways Work

Payment gateways act as intermediaries, connecting your online shop with the payment processing system. They securely transmit customer payment information from your website to the bank and back, ensuring that transactions are processed quickly and securely. Here’s how the payment gateway process works:

- Customer Starts Payment Process: A customer picks an item and moves forward to the checkout stage.

- Entering Payment Information: The customer enters their payment details.

- Encryption: The payment gateway encrypts this information to ensure security.

- Authorization Request: The gateway sends the transaction details to the acquiring bank for authorization.

- Transaction Approval/Denial: The bank approves or denies the transaction based on the customer’s funds and other factors.

- Completion: If approved, the payment is processed, and the funds are transferred to the merchant’s account.

Understanding this process is crucial for selecting the right gateway that ensures secure and efficient transactions.

Importance of Choosing the Right Gateway

The right payment gateway can enhance customer trust, reduce cart abandonment rates, and ensure smooth transactions. Factors to consider include transaction fees, ease of integration, security features, and the level of customer support provided. A poorly chosen payment gateway can result in transaction failures, increased chargebacks, and customer dissatisfaction.

Limitations of Traditional Payment Methods

While Stripe and PayPal are widely used, they do come with certain constraints:

- Geographic Restrictions: Availability may be limited in some countries, restricting your global reach.

- Transaction Fees: High transaction fees can significantly impact profit margins, especially for small businesses and startups.

- Account Holds and Freezes: There’s a risk of account holds or freezes, particularly for businesses in high-risk industries, which can disrupt cash flow.

- Limited Payment Options: Some customers prefer alternative payment methods not supported by Stripe or PayPal, leading to potential loss of sales.

WP Ultimate CSV Importer Pro

Get Ultimate CSV/XML Importer to import data on WordPress faster, quicker and safer.

9 Best WooCommerce Payment Gateways Reviewed

Square

Square is renowned for its intuitive design and seamless integration with WooCommerce. It accommodates a range of payment options, such as credit cards and digital wallets. Square is known for its simple setup and competitive transaction fees, making it a popular choice among small to medium-sized businesses.

- Simple Setup and User-Friendly Interface: Square’s intuitive design ensures a smooth onboarding process, allowing merchants to start accepting payments quickly.

- Competitive Transaction Fees: Square offers a transparent and straightforward fee structure, helping businesses manage costs effectively.

- Integration with Square’s Point-of-Sale (POS) System: This integration provides seamless synchronization between online and in-person sales.

- Comprehensive Reporting and Analytics: Square’s advanced reporting tools allow businesses to effectively monitor sales, manage inventory, and analyze customer data.

Square charges 2.6% + $0.10 per transaction for in-person payments, 2.9% + $0.30 per transaction for online payments, and 3.5% + $0.15 for manually keyed transactions. This predictable pricing helps businesses manage their transaction costs effectively.

Authorize.Net

Authorize.Net is a robust payment gateway that supports a wide range of payment methods and offers advanced fraud protection features.

- Extensive Payment Options: Accepts credit cards, e-checks, and digital payment methods.

- Advanced Fraud Detection Tools: Provides sophisticated fraud detection and prevention mechanisms.

- Recurring Billing and Subscription Management: Perfect for businesses that provide subscription-based services, these tools help automate the billing process and manage customer subscriptions effectively.

- Detailed Reporting and Customer Management Tools: Offers comprehensive reporting and customer management capabilities.

Authorize.Net has a monthly subscription fee of $25, coupled with a transaction fee of 2.9% + $0.30 per transaction. Additional charges may apply for utilizing advanced functionalities.

Adyen

Adyen is a comprehensive global payment gateway known for its extensive support of multiple currencies and payment methods, ideal for international businesses. Adyen offers a unified platform that simplifies the payment process by eliminating the need for multiple provider contracts.

- Wide Payment Method Support: Over 250 payment methods, including credit cards, digital wallets, and local options.

- Advanced Reporting and Analytics: In-depth analytics for transaction monitoring and process optimization.

- Seamless WooCommerce Integration: Smooth integration provides an efficient checkout experience.

- Enhanced Fraud Prevention: Leveraging machine learning algorithms for robust fraud detection and thorough risk management.

- Worldwide Presence: Enabling payment acceptance in more than 200 countries across the globe.

- Scalability: Ideal for businesses of any scale, whether you’re a small startup or a large corporation.

Adyen uses an Interchange++ pricing model, which includes interchange fees (to the cardholder’s bank), card scheme fees (to networks like Visa/Mastercard), and Adyen’s processing fee. European cards incur a fee of €0.11 + 0.60% per transaction, while fees for non-European cards vary. There are no setup or monthly fees, but a minimum invoice fee based on business activity applies.

Braintree

Owned by PayPal, Braintree is a versatile payment gateway that supports a wide range of payment methods and currencies. This makes it an excellent choice for businesses aiming to offer diverse payment options to their customers.

- Extensive Payment Options: Braintree works with credit and debit cards, PayPal, Venmo (only in the U.S.), Apple Pay, Google Pay, and other digital wallets. This broad acceptance ensures that customers can use their preferred payment methods.

- Advanced Fraud Protection: The platform offers robust tools for detecting and preventing fraudulent transactions, enhancing security for both businesses and customers.

- Seamless WooCommerce Integration: Braintree integrates smoothly with WooCommerce, making it easy for businesses to set up and manage their payment processes.

- Recurring Billing and Subscription Management: Ideal for subscription-based businesses, Braintree provides comprehensive support for recurring billing.

- Dedicated Merchant Accounts: Unlike payment aggregators, Braintree provides dedicated merchant accounts, giving businesses more control over their transactions and faster access to their funds.

Pricing Structure:

- Credit Card Payments: The fee is 2.59% plus $0.49 for each transaction.

- Additional Fees:

- 1% fee for transactions in non-USD currencies.

- 1% fee for transactions with cards issued outside of the United States.

- Venmo Transaction Fees: Each transaction incurs a fee of 3.49% plus an additional $0.49.

- ACH Direct Debit: The fee is 0.75% per transaction, capped at $5.

- Payment Gateway Fees: Braintree charges a $49 monthly fee plus $0.10 per transaction, with an additional $10 monthly fee for external merchant account fees.

These features and pricing structures make Braintree a comprehensive solution for businesses of all sizes, offering flexibility and security in payment processing

Nimbbl

Nimbbl is designed for quick integration and provides a smooth checkout experience with multiple payment options.

- Fast and Easy Setup: Nimbbl offers a quick and hassle-free integration process, allowing businesses to start accepting payments rapidly.

- Supports UPI, Wallets, and Cards: Nimbbl supports a variety of payment options, including UPI, various digital wallets, and major credit and debit cards.

- Zero Maintenance Fees: There are no ongoing maintenance costs associated with using Nimbbl.

- Optimized for Mobile Payments: Nimbbl ensures a seamless mobile payment experience, enhancing convenience for customers on the go.

Nimbbl offers custom pricing plans tailored to different business types and transaction volumes. They also provide volume-based discounts, making it a cost-effective solution for businesses with higher transaction volumes. This flexibility allows businesses to negotiate fees based on their specific needs and transaction amounts.

GoCardless

GoCardless specializes in direct debit payments, making it an excellent choice for businesses that rely on recurring billing models. It offers a streamlined and cost-effective solution for managing automated payments, particularly suitable for subscription services.

- Lower Transaction Fees Compared to Credit Cards: GoCardless provides a more economical alternative for recurring payments with lower fees than traditional credit card processing.

- Ideal for Subscriptions and Recurring Payments: Tailored for businesses that offer subscription services, ensuring consistent and automated billing cycles.

- Seamless Integration with WooCommerce: GoCardless integrates effortlessly with WooCommerce, facilitating smooth payment processing within your existing e-commerce platform.

- Automated Payment Collection and Reconciliation: This feature simplifies the payment collection process and ensures precise reconciliation, significantly reducing administrative tasks.

GoCardless charges 1% per transaction, capped at $2, making it highly cost-effective for businesses handling large volumes of transactions. For international transactions, the fee is 2.25% + $0.20 per transaction

WorldPay

WorldPay provides a comprehensive range of payment solutions, recognized for its strong security measures and extensive global reach. It facilitates smooth and secure transactions for businesses of any size, spanning a diverse range of industries.

- Supports a Diverse Array of Payment Methods: Accepts over 300 different payment options, including credit/debit cards, digital wallets, and alternative payment methods.

- Strong Fraud Prevention Tools: Offers robust security features to protect against fraud and manage risk.

- Detailed Reporting and Analytics: Provides comprehensive tools for monitoring transactions and gaining business insights.

- Global Payment Acceptance: Suitable for businesses with an international customer base, supporting multiple currencies and regions.

WorldPay tailors its pricing model to meet the unique requirements of each business. Typically, this includes a setup fee, monthly fees, and transaction fees that vary depending on the payment methods used.

2Checkout

2Checkout, now known as Verifone, provides a flexible payment gateway supporting various payment methods and currencies, making it ideal for global businesses. It offers comprehensive solutions for online merchants, including a variety of pricing and service plans tailored to different business needs.

- Supports Multiple Currencies and Languages: Facilitates global transactions by supporting over 100 currencies and multiple languages, making international expansion easier.

- Extensive Fraud Protection: Implements advanced fraud protection measures, including PCI Level 1 compliance, to secure transactions and prevent data breaches.

- Subscription Billing Options: Offers robust subscription billing tools, perfect for businesses with recurring billing models, including flexible pricing plans, trial management, and renewal options.

- Easy Integration with WooCommerce: Ensures a smooth and efficient setup process, integrating seamlessly with WooCommerce and other popular shopping carts.

The 2Sell plan from 2Checkout offers basic online payment processing at a rate of 3.5% plus $0.35 per transaction, with no monthly fees. The 2Subscribe plan, which includes advanced subscription billing features, charges 4.5% + $0.45 per transaction. This straightforward pricing is beneficial for businesses looking to expand globally without incurring high fixed costs.

Amazon Pay

Amazon Pay capitalizes on the trusted Amazon brand to deliver a secure and familiar payment experience, making it a favored option for online merchants.

- Efficient and Secure Checkout: Amazon Pay offers a streamlined and safe checkout process by using the customer’s existing Amazon account information, which helps reduce checkout steps and cart abandonment rates.

- Robust Security Measures: Utilizing Amazon’s advanced security infrastructure, Amazon Pay ensures secure transactions and includes comprehensive fraud protection.

- Seamless WooCommerce Integration: Amazon Pay easily integrates with WooCommerce and other major ecommerce platforms like Shopify, BigCommerce, and Magento, simplifying the setup process for merchants.

- Customer Trust and Familiarity: The Amazon brand is widely recognized and trusted, which can enhance customer confidence and potentially increase conversion rates.

Amazon Pay charges a fee of 2.9% plus $0.30 per transaction for web and mobile payments within the US. For international transactions, there is a fee of 3.9% plus $0.30 per transaction. Extra charges might be incurred for currency conversion and other specialized services.

Payment Gateways Across Countries

Different countries have varying preferences for payment methods. Here’s a brief overview of popular payment gateways in different regions:

- North America: Stripe, PayPal, Square, Authorize.Net

- Europe: Adyen, WorldPay, Klarna, Sofort

- Asia: Razorpay, Paytm, Alipay, WeChat Pay

- Australia: Afterpay, ZipPay, eWAY

Each of these gateways offers unique features tailored to the regional market, ensuring compliance with local regulations and preferences.

Charges Involved, Recurring Payments, and Dispute Handling

Understanding the cost structure and additional features of payment gateways can help you choose the right one for your business.

Transaction Fees and Hidden Costs

- Transaction Fees: These typically range from 2.5% to 3.5% per transaction, which can accumulate significantly for high-volume businesses.

- Monthly Fees: Some gateways charge monthly fees for their services, which can range from $10 to $50.

- Setup Fees: Initial setup fees may apply for certain gateways, although many offer free setup to attract new customers.

- Hidden Costs: Be aware of additional costs such as currency conversion fees, chargeback fees, and extra fees for premium features.

Managing Recurring Payments

- Subscription Management: Payment gateways like Authorize.Net, Braintree, and GoCardless offer robust subscription management features, automating billing cycles and managing customer subscriptions efficiently.

- Automated Billing: Supports automatic billing for recurring payments, reducing manual effort and ensuring timely payments. This feature is crucial for subscription-based businesses as it minimizes missed payments and improves cash flow.

Dispute Resolution Processes

- Chargeback Protection: Many gateways provide tools to manage and prevent chargebacks, which can be costly and time-consuming. These tools provide live alerts, fraud checks, and detailed transaction records.

- Dispute Resolution: Access to resources and support for resolving payment disputes is essential for maintaining customer trust and minimizing financial losses.

FAQs

1.Which one is the most suitable payment gateway for small businesses?

Some of the best options include Square, Authorize.Net, and GoCardless due to their ease of use, competitive pricing, and robust features.

2. What is the best way to select a payment gateway for WooCommerce?’ What is the best way to select a payment gateway for WooCommerce?

Consider factors such as transaction fees, supported payment methods, ease of integration, recurring billing features, and dispute handling capabilities. Assess your business needs and customer preferences to make an informed decision.

3. Can I use multiple payment gateways in WooCommerce?

WooCommerce offers support for a variety of payment gateways, enabling you to provide multiple payment methods for your customers. This flexibility can improve customer satisfaction and conversion rates.

4. Are there any free payment gateways for WooCommerce?

While most gateways charge transaction fees, some like PayPal offer no monthly fees, making them cost-effective for small businesses. Always consider the overall cost, including transaction and hidden fees.

5. What are the most secure payment gateways?

Gateways like Authorize.Net, Adyen, and Braintree are known for their robust security features, including advanced fraud detection, encryption, and secure data handling practices.

6. How do payment gateways handle currency conversion?

Many gateways, such as 2Checkout and Adyen, support multiple currencies and handle currency conversion automatically during the transaction process. This feature is essential for businesses operating in multiple countries.

Conclusion

Considering alternative payment gateways for your WooCommerce store can yield numerous advantages, such as lower transaction costs, a wider variety of payment options, and improved security features. By incorporating diverse payment methods, you can appeal to a larger customer base and enhance your conversion rates. Select a payment gateway that best matches your business requirements and customer preferences to streamline and optimize your eCommerce operations.